do you pay taxes when you sell a car in texas

The max combined sales tax you can expect to pay in Texas is 825. The Texas Comptroller also says that any Texas residents new or established and anyone that does business in the state must pay this tax.

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

When you sell a car for more than it is worth you do have to pay taxes.

. You will pay it to your states DMV when you register the vehicle. Instead the buyer is responsible for paying any sale taxes. If youre selling a car for less than you paid for it you will not have to pay taxes on it.

Instead the buyer is responsible for paying any sale taxes. For example in California the recipient must complete a Statement of Use Tax. If you sell it for less than the original purchase price its considered a capital loss.

Create Legal Templates Online. If as a resident of Texas you sell a car to someone in another state any sales tax is up to the buyer. You do not have to pay.

Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. Get a Custom CarMax Appraisal Offer Online so Youre the One in Control. Paying Taxes On Gifted Vehicles.

When you donate a car instead of selling it you can write off any donation up to 5000 according to the IRS Schedule A form 8283. The sales tax for cars in Texas is 625 of the final sales price. This means you do not have to report it on your tax return.

One thing you do need to make sure. How to Calculate Texas Sales Tax on a Car. The tax is a debt of the purchaser until paid to the dealer.

To be eligible the trade-in must be taken as part of the same sales transaction and transferred directly to the seller. If your trade-in is valued at 4000 and the new car is valued at 22000 youll only pay sales tax on the difference18000 in this case. Whether you actually complete paperwork provide a clerk with some information or well do anything is up to your state.

If you sell a car you dont have to pay sales tax on it. In most states the cars recipient must fill out the bulk of the paperwork and this includes tax paperwork. This is because you did not actually generate any income from the sale of the vehicle.

Thus you have to pay capital gains tax on this transaction. There is a 625 sales tax on the sale of vehicles in Texas. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes.

Once the buyer has the vehicle registered under his name he must pay to sell Texas. If the seller does not transfer or keep their license plates the license plates must be disposed of by defacing the front of the plates either with permanent black ink or another method in order to prevent fraudulent use. You buy a 30000 dollar car and trade in a 10000 dollar one.

Whoever buys it from Carmax for whatever they pay has to pay sales tax. Local tax rates range from 0 to 2 with an average of 1647. Youll pay tax on 20000 dollars.

Like New Wrecked or Not Running. Jim owes motor vehicle tax on the 15000 difference. Selling a car for more than you have invested in it is considered a capital gain.

While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. Get Personalized Documents in Under 10 Minutes. For more information about vehicle title transfers please call us at 888 368-4689 or 512 465-3000 or send us an e.

Do I pay tax when I sell my car Texas. So if you sell your car to carmax or to an individual keep in mind the difference in tax savings. However there may be an extra local or county sales tax added onto the base 625 state tax.

If the buyer is living in another state then the tax would need to be paid in that state not in Texas. Due Date The dealer will collect motor vehicle sales tax from the purchaser when a motor vehicle is purchased from a dealer in Texas if the motor vehicle has a gross weight of 11000 pounds or less. Looking To Sell Your Car.

Ad Create Your Bill of Sale Step by Step in Under 5 Minutes. The dealer will remit the tax to the county tax assessor-collector. Ad CarMax Offers You an Easy and Reliable Way to Sell or Trade In Your.

We Will Buy Your Car Truck SUV Today. However you do not pay that tax to the car dealer or individual selling the car. However if you sell it for a profit higher than the original purchase price or what is called a capital gain you must report the windfall on your income tax return and pay taxes on it.

Once the buyer has the vehicle registered under his name he must pay to sell Texas. Keep in mind that you have to add the money that you invested in the vehicle after the purchase to the amount that you originally purchased the vehicle for. We Can Get A Buyer To You Fast.

For example Jim purchases a 25000 vehicle and trades in his 10000 vehicle. The tax is computed on the remaining selling price for the purchased vehicle.

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax Brackets

How To Gift A Car In Texas 500 Below Cars

How To Fill Out A Car Title In Texas Where To Sign When Selling Car Youtube

Cash For Your Car In Mississippi Free Same Day Pickup Mississippi Birth Certificate Template Word Template

New Used Chevy Vehicles In Franklin Walker Chevrolet Chevy Vehicles New Cars For Sale Chevy

/images/2022/02/08/woman_in_car.jpg)

How To Legally Avoid Paying Sales Tax On A Used Car Financebuzz

Texas Used Car Sales Tax And Fees

After A Couple Days On The Market And A Couple Hours Going Over All The Offers We Re Undercontract Weatherfo Real Estate Texas Real Estate Moving To Texas

Virginia Sales Tax On Cars Everything You Need To Know

Printable Sample Bill Of Sale Form Bill Of Sale Template Sales Template Real Estate Forms

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

2007 Chevrolet Suburban For Sale In Texarkana Ar Cargurus Chevrolet Suburban Chevrolet Suburban

Texas Car Sales Tax Everything You Need To Know

How To Transfer My Texas Title Here S How With Examples

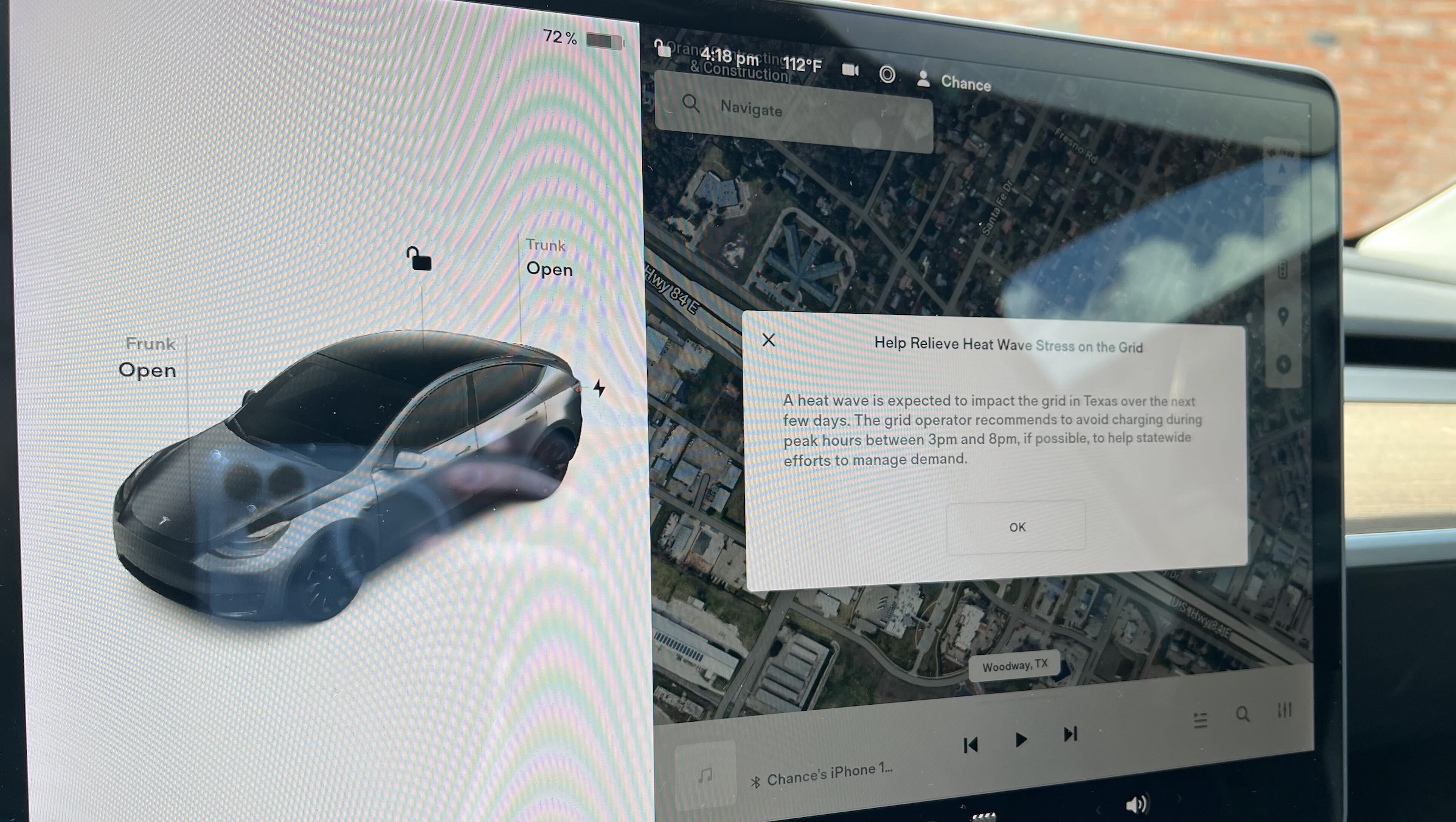

Tesla Tries To Help Texas Grid Amid Heat Wave With Its Cars Until It Can With Powerwalls Electrek

What S The Car Sales Tax In Each State Find The Best Car Price